A Simple Solution To Paying Down Credit Card Debt

posted

February 12, 2018

in

Blogs

Trying to pay down your credit card debt can be a long-term process, no matter what you owe. A great strategy is to get a balance transfer.

What is a balance transfer?

A balance transfer is taking the debt you owe to one lender (or several) and transfer to another card, usually to save on interest payments or to consolidate several payments in to one.

What should you look for in a balance transfer card?

When choosing a card for balance transfer, it’s important to research and compare card offerings. Many cards accept balance transfer, but it only makes sense if it will save you money.

- The balance transfer fee – Look for one that has no balance transfer fees; some cards charge a 3%-5% fee of the amount you plan to transfer, even though their offer might include 0% interest on transferred balances and new purchases.

- The interest rate on transferred balances – Look for one with a low introductory rate.

- The annual fee – Look for a card with no annual fee.

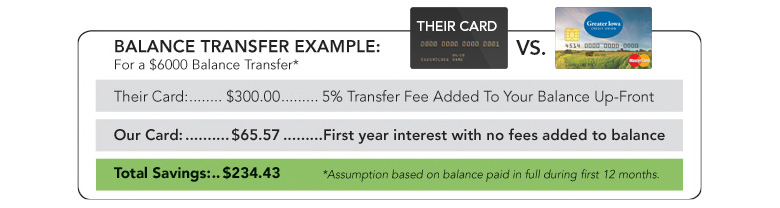

GICU’s Mastercard Platinum credit card is a great option for balance transfers. There is no balance transfer fee, no annual fee and members could qualify for a low introductory rate. Plus, you'll receive MasterCard® ID Theft Protection for free!

Do the math and see how much you can save!

- balance transfer

- credit card

- debt

- mastercard